Have you been thinking about going digital but are not sure if it will benefit you and have no idea where to start?

Jonathan Taylor, Managing Director at OMNIMax Software Solutions, answers your questions about going digital with your advice process.

How will automating my advice process support my business?

With an automated workflow, you’ll save time and that’ll allow you to handle a greater workload without adding more resources – ultimately improving your efficiency and profit margins. Output your statement of advice in just minutes.

Will a digital advice process help me when the new regime comes into force?

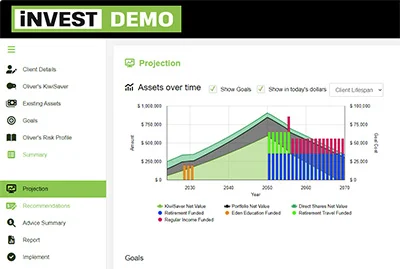

The new regime talks about making sure that clients understand the advice you give. By going digital you’ll be able to easily tick that box with visual outputs from your advice software. These outputs model different scenarios for your clients and show them the impact their decisions have on the outcome of their investments. Plus, record keeping is no longer an onerous task with complete audit trails of the advice you give.

Can I model and quickly compare scenarios for my clients?

We feel that modelling tools are an important part of the advice process to help clients easily understand the advice they’re being given. So we’ve developed a number of apps in this area to model investment scenarios with goals and visually show clients the value of the advice you give.

Is a digital advice process expensive?

It may not cost as much as you think! At OMNIMax a small upfront fee covers the setup of your solution, then a monthly subscription cost makes it much more affordable than developing something yourself. We’ve got plans from just $99/month.

Is it going to take a lot of time?

We do most of the work! You provide us with your templates, or you can use ours. We can have you up and running in just a few short weeks.

I use a software solution, but I can’t customise it, is this possible?

For sure! It can be very frustrating not being able to get your digital workflow to suit your business. We use our templates as a starting point and then alter to suit the way you work. Add or remove steps from the process, customise your risk profile and collect the information you need in a fact find.

My business is small, is there an option for me?

At OMNIMax, we have a range of cost-effective out-of-the-box solutions for small advisory businesses. These automate their advice workflow and are quick to get up and running. We also deliver scalable or bespoke solutions for larger organisations for KiwiSaver and investment as well as mortgage and insurance. We have worked with some large clients such as BNZ, but equally, we work with smaller advisory firms that may have just 1 or 2 advisors. Our software is very flexible.

This article was previously published on Good Returns in February 2021.