As a financial adviser, your days can quickly become full of meetings, admin, advice, market research and marketing activities. With so much to do, it can be difficult to find the time to complete everything on your to-do list, let alone add new tasks. However, a few key activities can help you save time and become more efficient.

Here are our 11 timesaving tips for Financial Advisers:

1. Use a Financial Advice Platform

One of the most effective ways to save time as a financial adviser is by using specialised tools, such as a financial advice platform. A financial advice platform can automate some of your advice processes to streamline your workflow and boost overall efficiency. These platforms are designed to handle various aspects of an advice process, from client onboarding to statement of advice generation to reviews. Using a platform to send or receive information from your clients, can also be more efficient for them as well.

2. Invest in CRM Software

Managing client relationships is a crucial part of your job, but it can also be time-consuming. CRM software can help you organise and streamline client communications, track important dates, and automate reminders for follow-ups. This way, you can stay engaged with your clients while focusing on high-priority tasks.

3. Use Digital Advice Tools

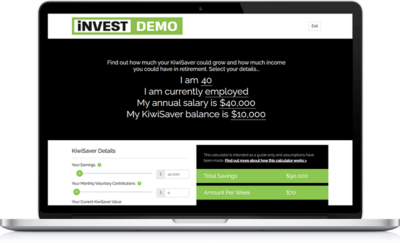

As well as financial advice platforms and CRM software, there are other digital tools that your advice practice can take advantage of. These include online fact finds and modelling or projection tools.

These tools will save you time, but they can also be more convenient for your customers and yourself. Your customers will appreciate being able to supply or update information at a time that suits them, and you will be able to access information at any time and from anywhere. Digital tools can also enable you to visually show the value of your advice, help to improve your cybersecurity and make automation easier.

4. Implement a Robo-Advice Solution for Basic Investment Advice

Robo-advisers are automated investment platforms that uses algorithms to manage and optimise clients’ investment portfolios. There are a range of robo-advisers available – some will ask for a client’s permission before acting, some won’t, and some allow advisers to have more input than others. Using a robo-adviser for basic investment advice frees you up to spend time with more complex clients.

5. Outsource to Experts

One of the most effective ways to save time is to outsource tasks that are not your specialty. These tasks could include admin, marketing, design, and IT. Experts in these areas can undertake these tasks quicker and often more effectively than you can. Outsourcing will save you time, which you can then invest elsewhere in your business. While outsourcing does come with a cost, you need to consider how much your time is worth. An expert will usually present better value for money.

6. Digitise Your Office Tools

Access your information from anywhere and at any time by digitising your office tools. You probably already use Outlook and other Microsoft Office tools but are there features included in your subscription to these, that you are not using? For example, rather than using a physical notebook to keep a task list, you could use Outlook Tasks or To Do.

Other digital office tools that could save you time and allow you to work more efficiently include a password manager (also essential to keep cybersecure), a virtual meeting tool such as Zoom or Teams, or a project management tool such as Asana.

7. Implement Efficient Meeting Scheduling

Managing your calendar and scheduling meetings can be a considerable time drain. Utilise scheduling tools that allow clients to book appointments directly, avoiding back-and-forth emails and phone calls. This not only saves time but also offers a convenient service to your clients.

There are many scheduling tools that can be put on your website. It’s best to ask your IT team or website developer which tools will suit your website. Some of these tools may not integrate with your calendar so you will need to carefully manage the times you set as available for appointments.

Microsoft Bookings is another tool that you may wish to consider. This integrates with Outlook and so when you set appointments in your Outlook calendar, it will make these times unavailable for booking via your website.

8.Automate, Automate, Automate

Consider which aspects of your business you can automate. In addition to automating any of your financial advice processes, you also want to consider areas outside of your advice processes. Can you automate your invoicing or monthly statements? Or perhaps can you send automated meeting reminders to your clients?

Customer service is another area to consider automating. The customer interactions you have that are repetitive or minimal impact can potentially be automated. It is important that you are selective with which interactions you automate, and that you also offer a way for customers to bypass this automation if they wish. Automation is the easiest for digital interactions. For example, you can setup an autoreply for enquiries that come in via your website or social media, to let your customer know their message has been received.

9. Stay Up to Date

Another key timesaving activity for financial advisers is to stay up to date with the latest market trends and regulatory changes. You may wish to sign up to industry association and publication newsletters, subscribe to podcasts or attend webinars and conferences.

10. Set Clear Work/Life Boundaries

Maintaining a healthy work-life balance is essential for everyone. But for those who work on the go or need to meet with clients outside of 9 to 5 business hours (such as financial advisers), the separation between work and home can be more easily blurred.

To avoid this, make sure to set clear work hours and try to avoid extending yourself beyond these hours too often. Ensure that you prioritise your personal time to rest and recuperate.

11. Regularly Review Your Processes

Take some time each year to review your processes and look for areas where improvements could be made. Spending time on this now will save you more time in the long run. For example, is there an existing process that needs some tweaks or is there a task you are undertaking manually that could be automated?

Also, consider asking your clients for feedback. Their different point-of-view could reveal areas for improvement that you haven’t considered.

There are many areas in which financial advisers can save time in order to work more efficiently. Digital technology such as an advice platform, robo–advice solution, CRM and office tools, all help to maximise your productivity. Automating other areas of your advice practice, staying up to date, setting clear work/life boundaries, and regularly looking for ways to improve your processes will also enable you to thrive in this competitive field.