Running a small advice practice in New Zealand isn’t easy, you wear a dozen hats, from client meetings to compliance checks. But here’s the tricky part, it’s rarely the big tasks that slow you down. It’s the little, invisible drags like double-handling client info, chasing up missing details, or rebuilding documents from scratch. These tiny frictions add up, often eating into evenings, weekends, or time you could spend growing your business.

How to spot the slowdown

If any of these sound familiar, your process might be holding you back:

- Copy-paste creep: You're juggling the same client info in a spreadsheet, Word doc, and maybe an email draft.

- Version roulette: "Final_v3_final" doesn't always feel final.

- Manual compliance checks: Scrambling to find emails or signatures for audits.

- Slow SOAs: Investment documents take hours, not minutes.

- Client stall-outs: The paperwork feels heavy, and clients delay or drop off.

What it costs you

Beyond the obvious lost hours, there are hidden costs:

- Opportunities missed: Less time to prospect, follow up, or do meaningful advice work.

- Compliance stress: Gaps in documentation or inconsistent notes.

- Client experience: Delays and frustration reduce trust and satisfaction.

Real-world examples

Consider an adviser with just 20 active Investment clients. Each SOA takes roughly 2–3 hours to complete manually. That’s 40–60 hours per month spent on documentation alone, nearly a full week of time lost. Multiply that across the year, and you’re looking at hundreds of hours that could have gone to client engagement, lead generation, or strategic growth.

Another common scenario – multiple team members update the same spreadsheet for client contributions, and suddenly the numbers don’t match. Reconciling the data takes additional time and introduces the risk of errors, mistakes that could affect client trust or compliance reviews.

Even solo advisers notice it. Juggling spreadsheets, Word templates, and emails means the process is fragile. A missed field or outdated version can trigger delays and stress, especially when the FMA compliance check looms.

Two levers that change everything

- Standardise: one path for client setup, advice creation, and reviews.

- Digitise: reduce manual handling so compliance and documentation become a by-product, not an extra job.

If spreadsheets are a core part of your advice process, they’re likely your biggest slowdown.

Next Steps

If this resonates, many advisers have already discovered a better way to save time and reduce errors:

- Read our next blog Still Using Spreadsheets? Here’s Why It Might Be Time to Upgrade to see how a digital workflow can transform your practice.

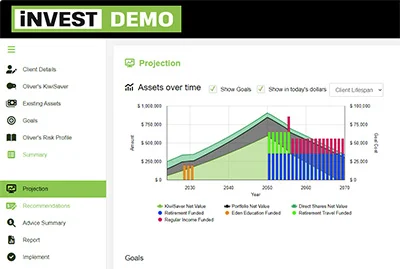

- Book a demo to see our Investment Adviser Tool in action and explore how your workflow could be simplified.