In our last article, Why Your Advice Process Might Be Slowing You Down, we looked at how sticking to old ways of working can hold advisers back. One of the biggest culprits? Spreadsheets.

For decades, financial advisers have relied on them for everything from calculations to client reports. They offer familiarity and a sense of control, but they weren’t designed for today’s advice needs.

While many advisers have already made the switch to financial advice software, others may not realise just how much time it can save, how much risk it can remove, or how simple it is to get started.

The Hidden Costs of Spreadsheets

Spreadsheets offer flexibility, but that often comes at a cost. They can be time-consuming to setup and maintain, prone to errors, and can often produce different outputs across users. Plus, clients today expect digital systems, not spreadsheets that feel outdated to many.

Spreadsheets also weren’t designed to manage complex, regulated processes. They can complicate compliance by making it harder to track changes, or meet requirements around advice documentation.

How Financial Advice Software Helps Advisers

Financial advice software is designed to solve the problems spreadsheets can't.

It allows advisers to:

- Standardise advice and documents across their advice business.

- Save time by automating calculations and document generation.

- Deliver a better client experience through an engaging, digital format.

- Support compliance with better audit trails, and documentation.

- Scale their business by freeing up time for client-facing activities.

Smarter, Faster Advice

Delivering financial advice often involves multiple steps: fact finding, product comparisons, recommendations, and client approval, with each step adding time and risk if done manually in spreadsheets.

Financial advice software simplifies this. It usually includes digital fact find tools, automated calculations, and document generation, all within a secure platform.

Some software also connects to public data sources (such as the Disclose Register), which ensures up-to-date performance and fee information is always available. Having these connections means that advisers no longer need to download PDFs or manually update performance tables in spreadsheets.

Supporting Complex Advice Needs

For more complex investment or retirement advice, spreadsheets make things even harder. Constantly adjusting assumptions, rechecking calculations, and managing multiple versions slows the advice process and increases the chance of error.

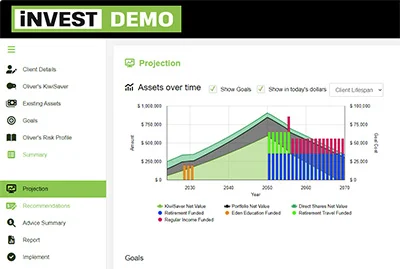

Projecting future scenarios is also made more difficult when using spreadsheets. Financial advice software also makes this easier. Projecting future outcomes, adjusting client goals or contribution levels, and instantly generating updated advice documents becomes easy, with no rebuilding formulas or juggling tabs required.

Using software also ensures that outputs are professional, easy to understand, and consistent across clients. Branded documents, digital approval options, and digital review processes all contribute to a better client and adviser experience.

Growing Your Business with Advice Software

Moving to financial advice software positions your business for future growth. If each advice process takes less time, each adviser can manage a larger book without sacrificing service quality. Using software can also increase the perceived value of your business, as clients are more likely to see you as a professional, forward-thinking adviser when you use modern tools. If you are looking to attract talent, you need modern systems. Younger advisers expect digital tools to be part of the workplace.

Leave Spreadsheets Behind

Financial advice software helps financial advisers work smarter, simplify compliance, and grow their businesses.

If you’re ready to spend less time on spreadsheets and more time giving great advice:

- Read 7 Reasons Why You Need a Digital Advice Process to see why a digital workflow solves common spreadsheet problems.

- Request a demo to see our solutions in action and discover how they can simplify your daily workflow.