If you’ve read 6 Ways Our Investment Adviser Tool Streamlines the Advice Process, you know the key features of our Tool – digital fact finds, projections, recommendation, and automated SOA generation. But how does it actually fit into your day-to-day workflow? Here’s the end-to-end journey advice practices follow when they use Investment Adviser Tool:

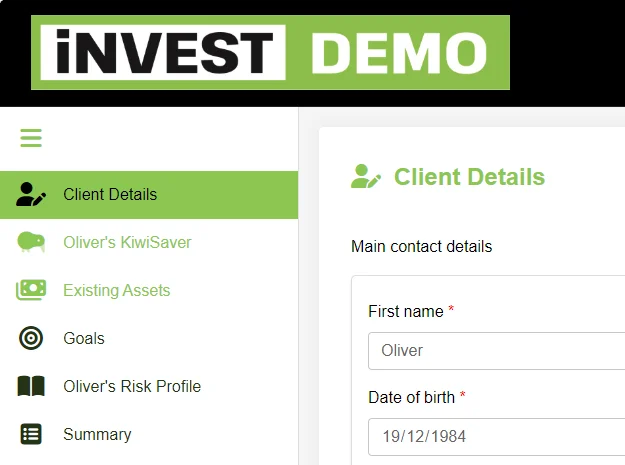

1) Send the Fact Find

Create the client record and send a secure portal invite with two-factor authentication to the client.

For clients who prefer in-person meetings or aren’t digitally comfortable, advisers can skip sending the Fact Find via email and instead complete it with the client during a meeting.

Why it matters: No lost emails, no scattered attachments. Every client interaction starts with a clear, traceable record, whether completed online or in person. The Tool ensures your workflow starts strong and client data is accurate from day one.

2) Client Completes the Fact Find

Clients (or advisers) fill in personal details, goals, contributions, and a risk profile assessment. Validation keeps data accurate and complete.

Why it matters: You no longer waste time chasing missing information. Structured data flows directly into your workflow, letting you focus on advice rather than admin.

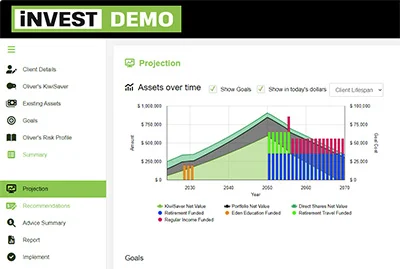

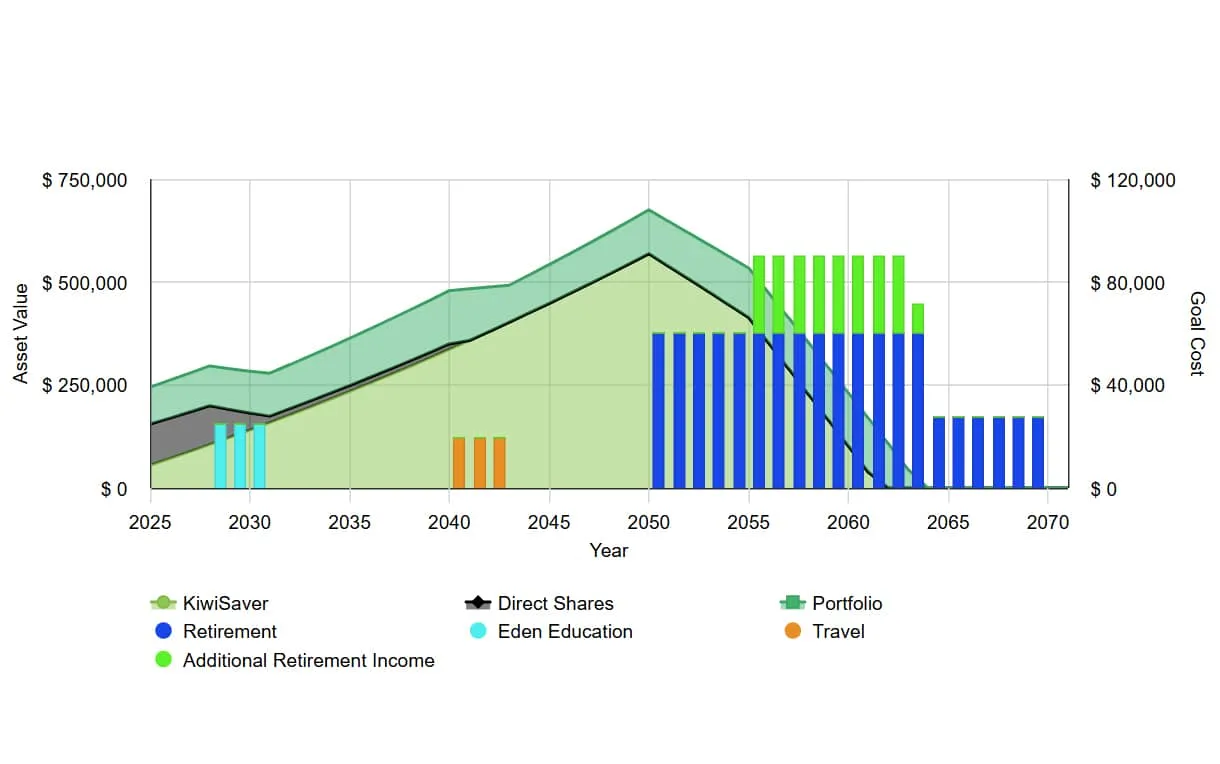

2a) Explore Scenarios with Projection Tool

Once client data is captured, our optional Projection Tool can model investment scenarios during a meeting with your client. You can both quickly see potential outcomes for various strategies, to help you client understand the impact of different decisions.

Why it matters: Scenario testing happens instantly within the workflow. Clients get clear, visual insights, and advisers can provide confident, evidence-based recommendations without leaving the Tool.

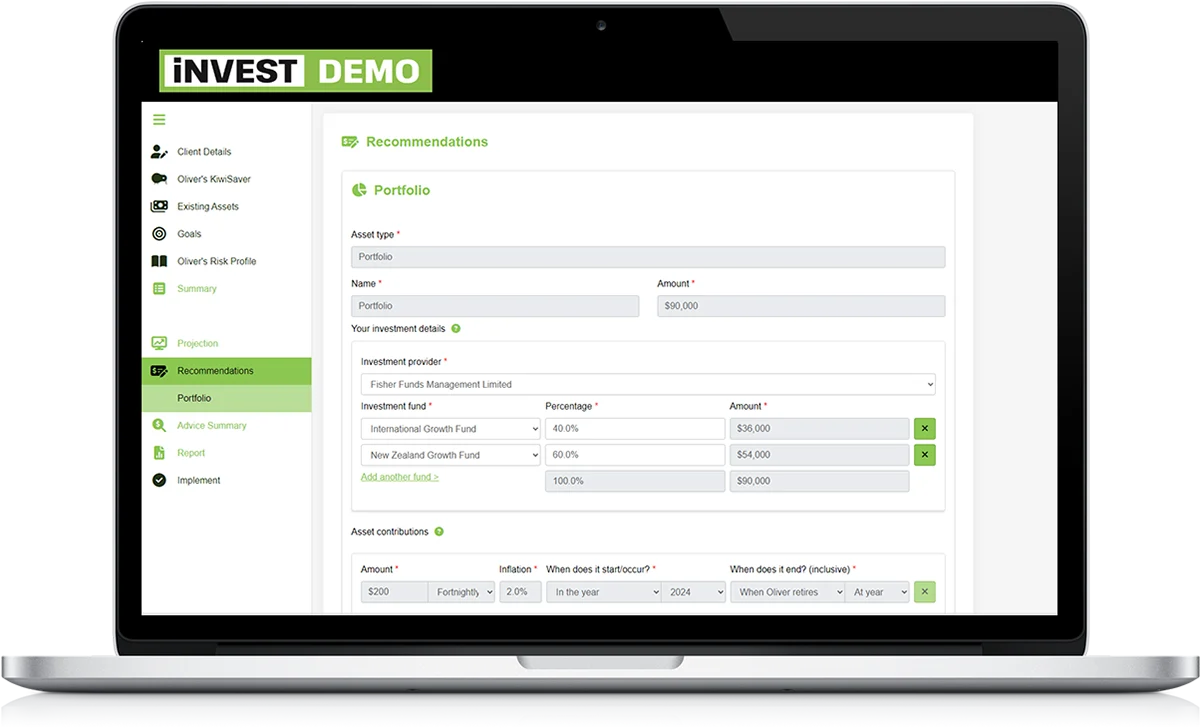

3) Make Recommendations

Build out the Portfolio(s) you created in Projection Tool (or create a recommendation from scratch if not using the Projection Tool). Select a provider, and fund(s) and nominate a percentage to invest in each fund. Contributions will pull through from Projection Tool or can be created from scratch. Record portfolio rationale(s), meeting notes, an overall recommendation summary and your plan fee.

Why it matters: By entering rationales and notes here, advisers ensure each recommendation reflects their professional judgement. The Tool automatically includes these details in the SOA, making it easy to produce clear and structured advice every time.

4) Generate the SOA

Click a button to generate your SOA, automatically populated with client data, investment projections, recommendations and rationale. The relevant factsheets for your recommended fund are also automatically included, as is historical performance data.

Why it matters: Branded, professional SOAs are produced in minutes instead of hours, with all relevant data included automatically. No copy-paste, no formula errors, and no missing supporting documents – letting you deliver high-quality, evidence-backed advice faster and more confidently.

5) E-Sign & Deliver

Send the Authority to Proceed for electronic signature, either in-person or via an email link.

Why it matters: Faster approvals, fewer delays, and a complete record of client agreements. Your clients get a smooth, professional experience, and you keep control of the process.

6) Improve Client Engagement

Clients receive automated notifications and can track task completion in the portal.

Why it matters: Engaged clients provide information faster and are more confident in the advice process. Less chasing, more clarity, and smoother interactions for everyone.

Why This Matters for Your Practice

- Handle More Clients: Automate routine tasks and focus on advice.

- Reduce Risk: Built-in audit trails and accurate record-keeping.

- Deliver Consistency: Every client gets the same high-quality experience.

- Save Time: Less admin, fewer errors, faster turnaround.

By digitising your full advice workflow, small teams can scale without stress, deliver consistent, high-quality advice, and give clients a modern, convenient experience.

Next Step

Book a demo to see Investment Adviser Tool in action and explore how your advice process could run smoother, faster, and more efficiently.