For decades, financial advisers have relied on manual tools like spreadsheets to manage advice delivery. While they can work for basic needs, they often create hidden inefficiencies, compliance risks, and client experience gaps.

In our previous article, Still Using Spreadsheets? Here’s Why It Might Be Time to Upgrade to Financial Advice Software, we explored how spreadsheets can slow you down, increase compliance risk, and limit scalability.

If those challenges sound familiar, this post takes the next step, showing why a fully digital advice process isn’t just a ‘nice-to-have’, but the foundation for faster, more compliant, and more client-friendly advice delivery.

Here are 7 reasons why you need a digital advice process:

1. Convenience

Convenience is an enormous benefit of going digital. Being able to email a client an online fact find or a Statement of Advice, allows your client to supply or review information at a time that suits them. Before this, clients would need to meet their adviser in person multiple times. This could be inconvenient for busy or remote clients.

For advisers, the benefits of going digital include those mentioned above. Going digital also allows advisers to keep all the financial information related to a client and the advice they receive in one location that can be accessed anytime and from anywhere.

2. Efficiency

Gone are the days of advisers waiting for the mail to arrive before they can create or update their advice. With a digital advice process, information can be shared or accessed instantly.

If advisers or clients prefer to meet in person, a digital process can still improve efficiency. During a meeting, advisers can enter client data into a system where it can instantly be used across different tools and won’t need to be entered multiple times.

A digital process often also involves automation. By automating some or all the tasks involved in an advice process, advisers spend less time performing and recording these tasks manually, improving their efficiency.

3. Compliance

A Financial Advice Provider (FAP) in New Zealand must disclose why they are doing what they are doing, at various stages in the advice process, to be granted a full FAP license.

Using a digital advice process can simplify disclosure, as at various stages of the advice process, electronic signoffs by clients can be recorded, with date, time, and location information.

4. Cybersecurity

Well-designed digital processes provide a secure environment for handling client information. Strong security measures such as encryption, multi-factor authentication, access controls, and regular data backups help protect sensitive data. These safeguards make it significantly more difficult for unauthorised parties to access client information, reducing the risk of fraud or identity theft compared to manual or paper-based processes.

5. Profit

An adviser's labour costs can be reduced by using a digital advice process. For example, using an automated advice workflow solution, can reduce the time it takes to create a Statement of Advice by up to 80%. With this extra time, advisers can take on new clients, increasing their profits.

Costs related to buying paper, printing, mailing, and storing documents are also reduced, further increasing profits.

6. New Clients

Digital solutions are commonly used and expected by those aged under 40. This age group includes first home buyers and those who are starting to get serious about saving for retirement. Advisers who need to ensure business continuity by attracting younger clients, need to ensure that they are meeting the needs of this generation by offering a digital advice process.

7. The Environment

Going digital means using less or no paper, reducing the environmental impact of the financial advice process.

Overall, a digital financial advice process is convenient, efficient, secure, environmentally friendly, compliant, and profitable. With these benefits in mind, it is not surprising that more advisers are opting for a digital approach to financial advice.

Next Steps

Ready to take the leap? Moving from spreadsheets to a digital process doesn’t have to be overwhelming. With the right approach, it can be done in a few straightforward steps.

- Read 6 Ways Our Investment Adviser Tool Streamlines the Advice Process to see how you can deliver advice faster.

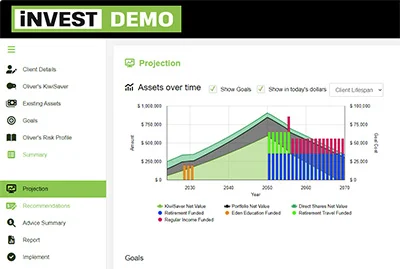

- Request a demo to see Investment Adviser Tool in action and explore how you can transform your advice process.